iD Fresh Food, the two-decade-old FMCG brand known for its packaged, ready-to-cook breakfast staples, recently announced its FY25 results. The Bengaluru-based company reported consolidated revenue from operations of INR 681.37 Cr, up 22% from INR 557.84 Cr in the previous fiscal year.

The total revenue went up by 22.27% to INR 688.22 Cr from INR 562.85 Cr in the previous fiscal.

“We are now aiming to grow at a consistent pace of 20-25% year over year while remaining EBITDA positive,” the brand’s India CEO Rajat Diwaker told Inc42 in an exclusive interaction.

This trajectory implies a target of INR 1,100-1,200 Cr in operating revenue by FY27. The company is also gearing up to become IPO-ready by then, but the grapevine has it that the brand is eyeing a pre-IPO secondary sale worth about INR 1,200 Cr.

Diwaker dismissed the industry buzz, calling the figures “highly speculative”. Moreover, several factors must align before a company can affirm it is IPO-ready.

“We are not there yet. It may take another year or two to strengthen our business delivery and implement the necessary processes. As for the IPO, yes, we do want to go public. But whether that happens in FY27, FY28, or the year after is uncertain at this stage,” he added.

iD Fresh Food was launched in 2005 by PC Musthafa and his four cousins — Shamsudeen TK, Jafar TK, Abdul Nazer and Noushad TA. It has so far raised INR 338 Cr from marquee investors such as Sequoia Capital, Helion, Premji Invest and NewQuest Capital Partners (acquired by TPG in 2021).

Despite its strong presence across India and operations in nine overseas markets, the fresh food brand had been a loss-making entity for decades. It was only in FY24 that the company clocked INR 4.56 Cr as consolidated profit before tax (PBT).

The momentum continued in FY25, with PBT rising nearly sixfold to INR 26.7 Cr.

Diwaker said the brand’s unit economics had always been robust, with individual products generating healthy margins from the outset. The problem was scale, as the company expanded aggressively across geographies and categories. Its fixed costs had grown, driven by investments in infrastructure, facilities and organisational growth. That was why margins were not visible at the EBITDA level.

“From FY24, we accelerated growth, ensuring that operating leverage would begin to take effect. It means when fixed costs are absorbed, every additional sales dollar accelerates profits. That, in turn, lifted our EBITDA growth,” he added.

Growth did not pick up overnight. It was the result of a two-pronged expansion strategy that the brand pursued with focus and discipline. iD Fresh Food started as a mono-product business, selling only idli-dosa batter for the first few years. But it gradually widened its reach across new markets and product categories.

Extending FootprintWithin India, the brand moved from South to West and North, operating in more than 60 cities. It also set up two wholly owned subsidiaries in the UAE and one each in Oman, the Kingdom of Saudi Arabia (KSA) and Bahrain. Additionally, it runs a small exports business catering to markets such as the UK, Ireland, the US and Canada, per the company’s FY25 financial statement.

It recently entered 11 new cities in northern India and plans to expand to 100 local and global destinations by 2027. According to Diwaker, the brand will focus on new cities with strong modern trade networks. Currently, India is its biggest revenue earner, while Dubai leads international sales, followed by Saudi Arabia.

Growing The Product LineiD Fresh Food gradually expanded to ready-to-eat parotas made across its production units in Bengaluru, Hyderabad, Mumbai, Haryana and Dubai. Along the way, it started trading food products such as curd, paneer, coffee and other fresh staples.

In the past 18 months, the company has grown its product line from 13-14 SKUs to more than 35, fuelled by new category launches and premium extensions within existing lines. It plans to add more production units by FY27 to sustain this momentum.

Decoding The Growth Playbook“It has been a steady climb,” said Diwaker. “One of the reasons why we remain strong even after 20 years and continue to scale is that we have always put a premium on consistent revenue growth at the right cost, rather than growing in spurts and then slowing down.”

In the FMCG sector, especially in perishable food categories with short shelf lives of four to seven days (similar to iD Fresh Food), four factors primarily drive user acquisition and retention. These are product quality, channel availability, category innovation, and new customer acquisition.

iD Fresh Food has been one of the early movers in its operating markets, building reach across general trade, modern retail, ecommerce and quick commerce.

“We are part of the consumer’s breakfast basket. So we need to be available early in the morning when they start shopping for breakfast items,” said Diwaker. “Our go-to-market strategy is built around that availability across channels.”

Diwaker also noted that the best strategy to retain consumers is to offer consistent product quality at the right price. “If these two factors are managed well, people will keep coming back,” he said. “For us, that means ensuring our products are available across every sales channel where consumers shop. We use technology to deliver consistent quality at the right price every single day. That’s how enduring consumer trust is built.”

Here’s how Key strategies plays out on the ground.

Maximum Freshness, Minimum WasteFor iD Fresh Food, managing perishables begins long before the products reach store shelves. Temperature control and waste reduction shape every decision across the company’s supply chain, irrespective of sales channels.

All products moving from production units to outlets and distribution centres (DCs) are kept within a precise temperature window, as a brief fluctuation can affect food quality.

“Hence, we invest in the right vehicles and temperature-controlled infrastructure, ensuring consistency through every stage of delivery,” said Diwaker.

Waste management is just as critical. No product can sit idle when shelf life is measured in days, not weeks. Production begins only after the company forecasts the next day’s demand for each city. Sophisticated prediction systems now guide its plants to produce almost to the decimal, enough to supply retailers and fill the shelves, but not to flood them.

In essence, the company’s supply chain is channel-agnostic and built on a single principle — delivering fresh products to consumers without losing a day. That discipline extends across neighbourhood stores, supermarkets and quick-commerce platforms alike. There is no room for error with only a few days to sell.

The ‘Right-To-Win’ Playbook To Explore New CategoriesEach time the brand explores a new category, it follows a ‘right-to-win’ framework, a structured approach that weighs the total addressable market (TAM), differentiated product, whether the new product shares the same customers & consumers, the synergies in supply chain and manufacturing, and finally, whether the brand equity lends itself well to the product in consideration.

The company allows each new product to stabilise for up to three years before deciding on further investments. Understandably, some experiments did not scale as expected. For instance, the brand launched a bread line but discontinued it after 36 months.

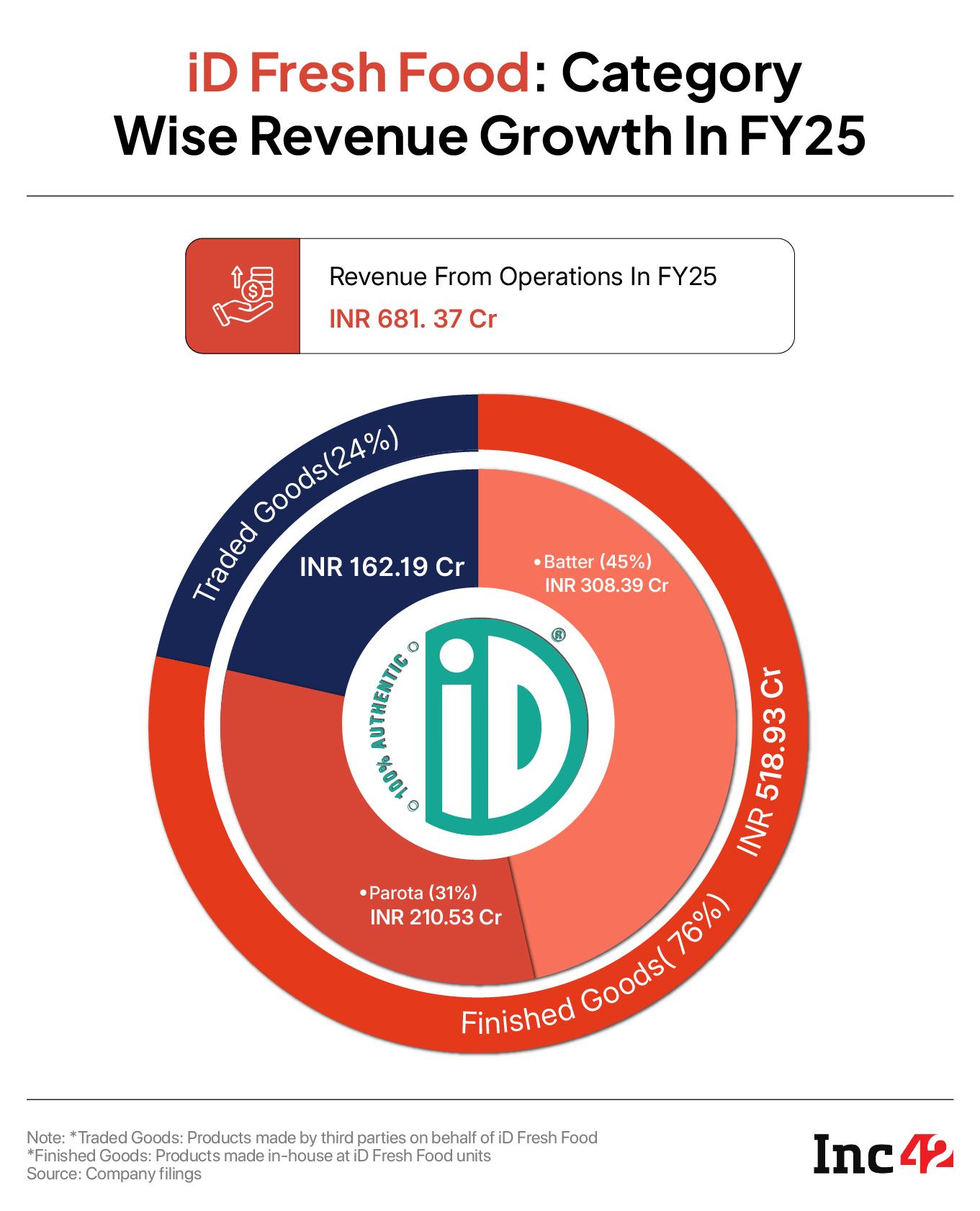

As of now, the company’s product portfolio is divided into two categories — finished goods and traded goods. Finished goods include batter and parota, while traded goods comprise products made by third parties on behalf of iD Fresh Food, such as chapati, dairy products, beverages, frozen fruit, chutney, and stuffed parota.

Currently, finished goods contribute the majority share of revenue at around 76%.

While planning its new user acquisition strategies, iD follows a structured and consistent approach to drive growth. As Diwaker highlighted, for a company targeting around 26% annual growth, volume growths have to be robust along with pricing/ mix across its core categories of batter & parota.

The company thus focusses on maximising reach and frequency through appropriate media plans, maintaining steady monthly investments rather than sporadic bursts of spending. Majority of their marketing spends are allocated towards media.

Most of the brand’s digital-first advertising spans Google, Meta, YouTube and OTT platforms. It is supported by a steady flow of in-house content rolled out on the brand’s platforms. The rest of the marketing budget covers offline promotions and local activities.

“In recent years, we have started integrating AI tools across multiple functions,” said Diwaker. “In marketing, AI is increasingly used for packaging, creatives and ad films. Beyond marketing, the brand employs AI-driven systems for quality control across our plants, reinforcing our commitment to technology-led process optimisation.”

The challenge now lies in maintaining its disciplined approach as the company scales.

The coming years will tell us whether iD Fresh Food can sustain its pace without losing operational focus or financial control and reach the INR 1,100 Cr milestone to emerge as a stable public enterprise.

Edited by Sanghamitra Mandal

The post Batter Worth Millions: Decoding iD Fresh Food’s INR 1,100 Cr High-Stakes Growth Story appeared first on Inc42 Media.

You may also like

Iris Hsieh cause of death: How did the Taiwanese influencer die at 31

Belgium drones LIVE: Airspace closed as flights cancelled at Brussels and Liège airports

ITV Emmerdale fans 'work out' Kev's true intentions for Robert in dark twist

Nigel Farage explodes at Rachel Reeves as he rips into pre-Budget speech

CBDT successfully achieves targets of Special Campaign 5.0